The Boston Consulting Group (BCG) periodically identifies 100 companies from rapidly developing economies as “global challengers.” (Bcgperspectives, “Introducing the 2013 BCG Global Challengers“). BCG has identified 100 companies for this list in 2006, 2008, 2009, 2011 and 2013. They focus on companies in developing Asia (excluding Japan, South Korea, Taiwan, Hong Kong and Singapore), Eastern […]

Striking photographs of Oaxaca by Cynthia Roderick

Cynthia Roderick is an award-winning photographer whose work has been widely published in major newspapers, magazines and TV news programs. However, I had not realized until recently that Roderick has a strong affection for Oaxaca. Several portfolios of work related to Oaxaca can be accessed via her website: Ocotlan Small Animal Market (23 images) Zaachilla […]

Implementing President Enrique Peña Nieto’s “Pact for Mexico”: a lesson in Mexican Civics

In an earlier post, we described President Enrique Peña Nieto’s very ambitious “Pact for Mexico”. Very briefly, the Pact addresses 95 important issues in five broad categories: reducing violence, combating poverty, boosting economic growth, reforming education, and fostering social responsibility. Achieving these reforms will require passage of new legislation by a majority in both houses […]

Mexico’s geomorphosites: El Sótano de las Golondrinas (Cave of the Swallows)

El Sótano de las Golondrinas, in the municipality of Aquismón in the state of San Luis Potosí, is a massive limestone sinkhole (pit cave), one of the largest known in the world. In terms of depth, it is thought to be the second deepest sinkhole in Mexico and is probably in the world’s top 20. […]

Empty houses in Mexico

On-going rural-urban migration has led to a proliferation of metropolitan areas and the construction of millions of new homes across Mexico. Thirty years ago, there were only 15 recognized metropolitan areas in Mexico, today there are 59. In recent decades, there has been insufficient coordination between the various government departments responsible for housing, services and […]

Mexico seen as the “Flavor of the Month” among Latin American Economies

In a presentation entitled “Mexico’s Outlook” in Ajijic, Jalisco, Mexico, on 20 March 2013, noted Mexican political economist Leo Zuckermann explained how many economists see Mexico as the “flavor of the month” among Latin American economies. Brazil previously was the star of Latin America as evidenced by the 14-20 November 2009 cover of The Economist. […]

Mexico has the world’s highest level of energy security among large economies

According to a recently published U.S. Chamber of Commerce study of the largest energy-consuming nations, Mexico is the most energy secure country of the 25 countries in the large energy user group with a score 14% below the OECD average (see graph). The study compiled an “International Index of Energy Security Risk”, taking into account […]

Environmental news briefs relating to Mexico

This post describes several newsworthy developments relating to Mexico’s natural environment. Financing to fight deforestation The Inter-American Development Bank is giving Mexico $15 million in financial and technical assistance to support climate change mitigation efforts. The program will help communities and ejidos finance low carbon projects in forest landscapes in five states, all of which […]

Popocatapetl Volcano and Colima Volcano continue to erupt

In our series of brief updates on topics featured in previous Geo-Mexico posts, we look this week at the continuing eruption of two major volcanoes: Popocatapetl Volcano (between Mexico City and Puebla) and Colima Volcano (on the Jalisco-Colima state border in western Mexico). Since our previous post, about a year ago, entitled Alert level rises […]

How does corruption in Mexico compare to Brazil, China, India and Russia?

Corruption is a serious concern in Mexico and these other four major emerging economies. Corruption is rather subjective and not an easy concept to measure. This post looks into corruption in Mexico, Brazil, China, India and Russia, as reported by Transparency International (TI) in its Perceived Corruption Index 2012 and the World Justice Project (WJP) Rule of […]

Welcome to our second quiz about the geography of Mexico. (The first quiz is at How well do you know Mexico? The geography of Mexico: Quiz 1) How many of the following can you answer correctly? This time, if you answer a question incorrectly, you can have more attempts at each question before the answer […]

“Visions of San Miguel. The Heartland of Mexico”, a book about San Miguel de Allende in Guanajuato, portrays the city, its people and its fiestas, as seen through the lenses of thirty talented photographers. This visually exciting book is an ideal introduction to San Miguel de Allende for the armchair traveler, or a perfect memento […]

President Enrique Peña Nieto’s “Pact for Mexico”

President Enrique Peña Nieto has proposed a 34-page “Pact for Mexico” which addresses 95 important issues in five broad categories: reducing violence combating poverty boosting economic growth reforming education fostering social responsibility Though there are few details, the Pact specifically calls for: Universal Social Security, Unemployment Insurance and Health Care Systems Providing every public school […]

Angahuan, the nearest village to Paricutín Volcano in Michoacán, Mexico

Last month we recounted the events surrounding the birth of Paricutín Volcano in 1943 in the state of Michoacán in western Mexico: Paricutin Volcano in Mexico celebrates its 70th birthday Angahuan, the nearest village to Paricutín Volcano, is fascinating in its own right, quite apart from its connections to the volcano. The village has a […]

Does Mexico have an “Open Government”?

The World Justice Project (WJP) 2012-2013 Report recently assessed 97 countries on eight Rule of Law factors. The “Open Government” factor involves engagement, access, participation, and collaboration between the government and its citizens. It includes accountability, freedom of information, and ability to petition the government. The WJP ranked Mexico 32nd of 97 countries in terms […]

Map of Yucatán Peninsula including Campeche, Mérida, Cancún, Riviera Maya and Cozumel

Mexico’s Yucatán Peninsula, a low, flat limestone platform, is the most recently formed part of Mexico. The low topography, which is quite similar to western Cuba and southern Florida, is virtually all below 150 m (500 ft). The submerged western and northern portion of this platform is known as the Campeche Bank. The peninsula was […]

The world’s richest man is one of 15 Mexican billionaires on 2013 Forbes list

The 2013 Forbes list of the world’s billionaires shows that the world’s 1,426 billionaires (an all-time high) share a record net worth of $5.4 trillion. The four countries with most billionaires are the USA (442), China (122), Russia (110) and Germany (58). Fifteen Mexican individuals or families make the 2013 list, also a record number. […]

Reforms badly needed for Mexico’s criminal justice system

The World Justice Project (WJP) 2012-2013 Report recently assessed 97 countries in terms of Rule of Law, which the WJP defines as “the underlying framework and rights that make prosperous and fair societies possible… where laws protect fundamental rights, and where justice is accessible for all”. Its definition includes four universal principles: The government and […]

Mexico’s tourist industry plans to increase tourist expenditures

The tourism and travel industry in Mexico accounts for about 13% of GDP. Speaking last month at the XI National Tourism Forum in the resort city of Cancún, Mexico’s Tourism Secretary Claudia Ruiz Massieu outlined the National Tourism Strategy 2013-2018. The new plan places more emphasis on increasing the average expenditures of tourists than on […]

Mexico’s population: now over 117 million and expected to peak at about 138 million

Mexico’s population in January 2013 was 117.4 million; 57.3 million males (48.8%) and 60.1million (51.2%) females according to a December 10, 2012 report by CONAPO (Consejo Nacional de Población) in “Proyecciones de la población de México 2010-2050”. By January 2014 it will grow by over a million to 118.6 million. However demographic trends indicate that population […]

How well do you know Mexico? How closely have you been reading Geo-Mexico: the geography and dynamics of modern Mexico and our Geo-Mexico blog? Let’s find out ~ Good luck!

Paricutin Volcano in Mexico celebrates its 70th birthday

Today (20 February 2013) marks the 70th anniversary of the first eruption of Paricutín Volcano in the state of Michoacán in western Mexico. The landscape around the volcano, which suddenly started erupting in the middle of a farmer’s field in 1943 and which stopped equally abruptly in 1952, is some of the finest, most easily […]

The geography of Mexico’s drug trade: new cartels involved in turf wars

As we suggested a year ago – Mexico’s drug cartels and their shifting areas of operation, a 2012 update – it is increasingly difficult to track the areas of operation of the major drug trafficking groups in Mexico. The U.S. Department of the Treasury’s Office of Foreign Assets Control recently added a new narcotrafficking group […]

The geography of the Huichol Indians: cultural change

Huichol Indians may have retained many of their ancestral traditions, such as shamans and their annual cycle of ceremonies, but Huichol culture has changed significantly in the past three hundred years. During colonial times, the Huichol adopted string instruments, the use of metal tools, and the keeping of animals such as sheep, horses and cattle. […]

Which political party has the most state governors?

Mexican governors are elected for single six-year terms; re-election is not permitted by the Mexican Constitution. The terms of governors in different states overlap; for example, seven of the 32 governors began their term of office in 2012. The PRI (Partido Revolucionario Institucional, Institutional Revolutionary Party) currently holds 19 of the 32 governorships spread throughout […]

The crater lake of Santa María del Oro yields evidence for climate change

A magnificent crater lake nestles in a centuries-old volcanic crater a short distance east of the town of Santa María del Oro in Nayarit. The connecting road from Highway 15 first passes through the former mining town of Santa María del Oro and then rises slightly to offer a splendid view of the beautiful slate-blue […]

Ecological footprints, marine conservation and Cancun’s underwater sculpture park

The Global Ocean Commission, a new, high-level international effort to try to stave off eco-disaster in the world’s oceans, is being launched tomorrow in London, U.K.. Headed by former UK foreign secretary, David Miliband, former South African finance minister Trevor Manuel, and José María Figueres, a former president of Costa Rica, the Commission will promote […]

The cultural geography of Mexico’s carnival celebrations

Carnival celebrations are underway in many Mexican towns. Carnival (carnaval) is a time for merry-making in the days prior to Ash Wednesday, the beginning of Lent in the Christian liturgical calendar. (In 2013, Ash Wednesday falls on 13 February.) Carnival originated in Italy and was introduced into Mexico several centuries ago by the Spaniards. Even […]

The geography of the Huichol Indians: economy, lifestyles and settlements

In this post we take a closer look at the traditional life and settlement patterns of the Huichol Indians. The origins of the Huichol are unclear. The Wixárika themselves believe they arrived in the Jalisco-Nayarit area from the Valley of the Mexico, though most anthropologists believe it is more likely that they came originally either […]

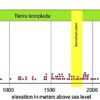

What is the elevation of Mexico’s cities?

The short answer to “What is the elevation of Mexico’s cities?” is “somewhere between zero and 3000 meters (8200 ft) above sea level!” Mexico’s extraordinarily varied relief provides settlement opportunities at a very wide range of elevations. Many Mexican cities are at or near sea level. This group includes not only coastal resort cities such […]