Remittance payments are one of the world’s major international financial flows. Mexican migrants in the USA send more than 20 billion dollars a year in total back to their families and friends. But how exactly are remittance payments made?

A 2005 World Bank study led by Raúl Hernández-Coss entitled “The U.S.–Mexico Remittance Corridor: Lessons on Shifting from Informal to Formal Transfer Systems” answers these questions, with a detailed analysis of the mechanisms and constraints of remittance transfers between USA and Mexico.

The mechanisms used to send money home can be broadly divided into two categories: formal and informal. Formal transfers use the regulated financial systems of the two countries concerned, in this case of USA and Mexico. Formal transfers include those made via banks, credit unions, wire transfer services and postal services. For formal transfers, migrants choose between direct “electronic” transfers from one bank to another, or sending a bank check by post or with a friend, or providing the recipient access to a bank account via an ATM card.

Informal transfers are all the other ways in which funds are repatriated: via ethnic stores, travel agencies, unregistered money changers, courier services, hawala-type systems (informal value transfer systems) and hand-delivery.

Funds sent via formal channels are better monitored and more secure than funds sent via informal channels. Does this mean that personal remittances might be a good way to repatriate drug profits? The researchers involved in the World Bank study do not believe so:

“Personal remittances, such as migrant worker remittances, have not been widely associated with money laundering schemes, with the exception of “smurfing” (dividing transfers into smaller packages to evade reporting requirements on larger amounts). Larger transfers, such as those related to trade, generally have higher utility for money laundering schemes than do personal transfers of small amounts.”

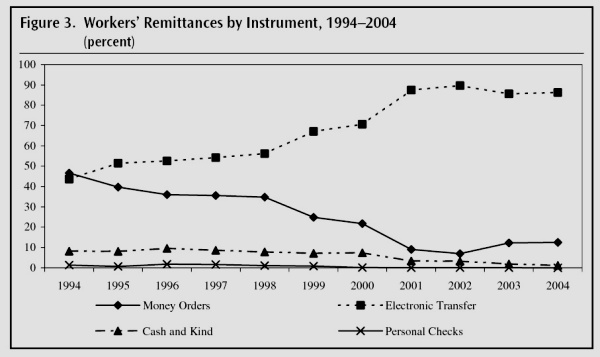

The statistics for the value of remittances are based largely on formal transfers. One clear trend, reflected in data from Mexico’s central bank (Banxico), is that migrants are increasingly choosing to send funds using direct electronic transfers (see graph), rather than by personal checks or money orders.

In a future post, we will try to answer the question, “What factors affect migrants’ decisions about the best way to send their money back to Mexico?”

Related posts:

- Mexican migrants and remittances: an introduction – this has numerous links to many aspects of USA-Mexico remittances

Sorry, the comment form is closed at this time.