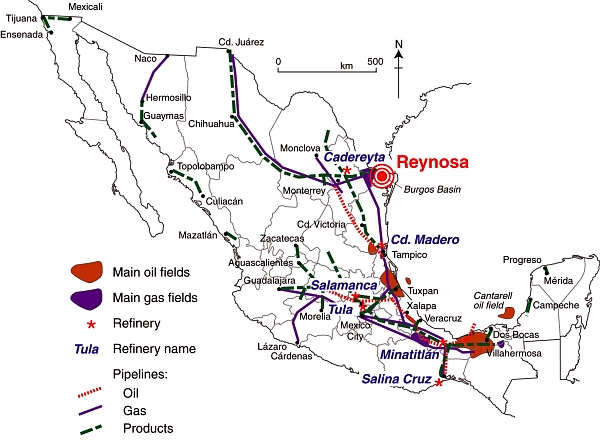

State-owned Pemex currently has six oil refineries in Mexico, which process around 1.05 million barrels/day (b/d) of crude.

The company has now shelved plans to add a $10-billion refinery at Tula (Hidalgo) owing to doubts about its long-term viability. It does seem that it is unlikely to be needed since Mexico’s energy reforms have led to several private companies submitting proposals to build less expensive, modular “mini-refineries” in Mexico. Each of these mini-refineries is 80-90% smaller than any of the six giant Pemex refineries.

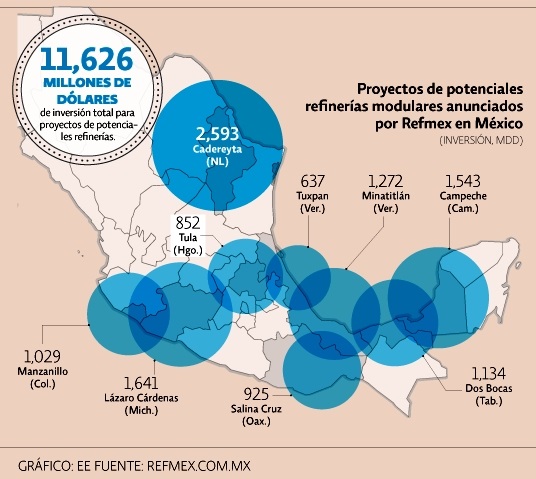

A consortium of U.S. firms, Refinerías Unidas de México (Refmex), plans to invest 11.6 billion dollars to build 9 mini-refineries, starting with a $1.5billion refinery in Campeche with the capacity to refine between 40,000 and 60,000 b/d. Construction would take between 18 and 30 months.

Other proposed locations (map) include Cadereyta (Nuevo León), Dos Bocas (Tabasco), Minatitlán (Veracruz), Lázaro Cárdenas (Michoacán), Manzanillo (Colima), Salina Cruz (Oaxaca), Tula (Hidalgo) and Tuxpan (Veracruz). Several of these locations are in the recently announced federal Special Economic Zones, which offer fiscal incentives to investors.

Related posts:

- Pemex: the government cash cow that environmentalists love to hate (Jul 2011)

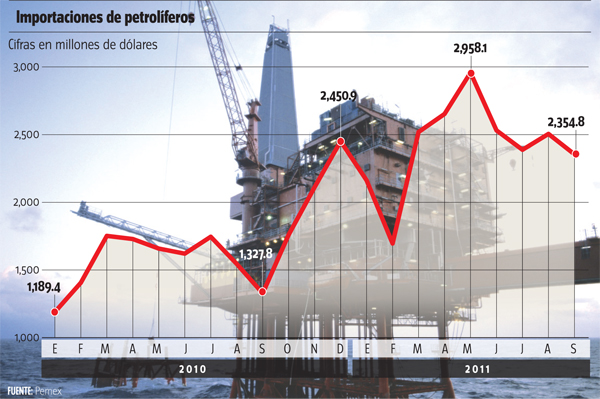

- Why does Mexico need to import refined petroleum products? (Nov 2011)

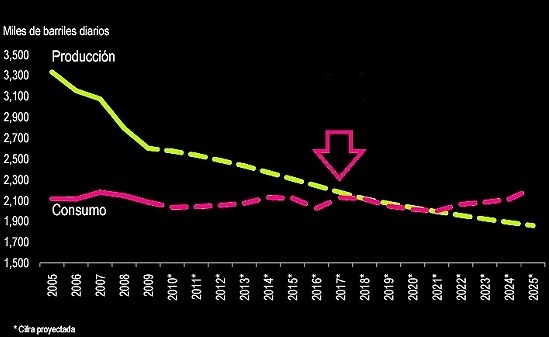

- How long will Mexico’s oil reserves last? (Apr 2012)

- How many oil refineries does Pemex have? (Sep 2012)

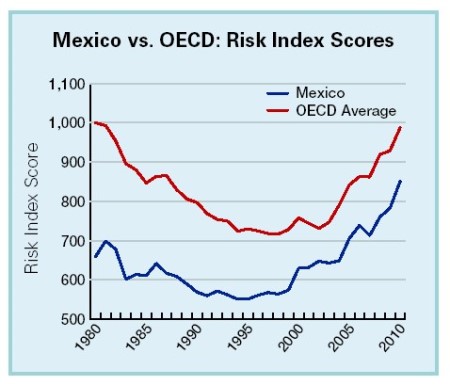

- Mexico is the world’s most energy secure among large economies (Apr 2013)

- Pemex works at its Clean Fuels Policy (May 2014)

- All Pemex refineries now making clean fuel (Jun 2016)