A series of press reports over the past six months has shed interesting light on the variety of ways in which the Knights Templar cartel raises funding and manages its finances. The Knights Templar stronghold is the city of Apatzingan in Michoacán, but the cartel now operates in several states, including Guerrero.

Raising money:

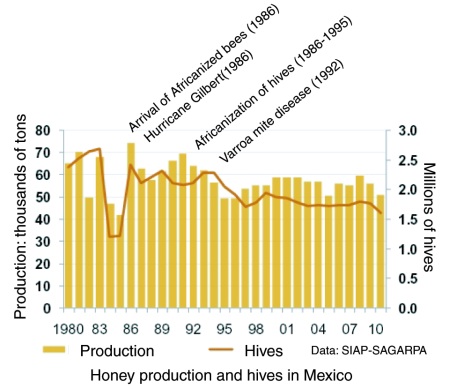

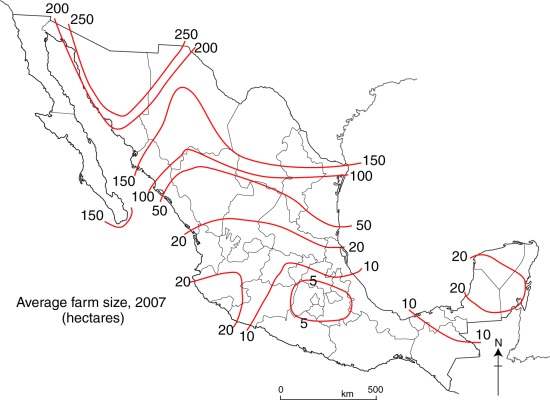

1. Citrus and avocado production and exports

In January 2013, Alberto Galindo, spokesman for the Plan de Ayala National Movement, one of the largest organizations of Mexican farmers, claimed in a press interview that Mexico’s avocado farmers “have data that prove that 225 million pesos [17 million dollars] is the amount extorted by the drug cartels in Michoacán” each year. Citrus growers are also subject to regular extortion by the Knights Templar. We reported on avocado “protection money” back in 2012, and on the plight of citrus farmers in 2011.

2. Iron ore mining and exports

The Knights Templar levy “passage fees” on every ton of iron ore leaving mines in Michoacán for the port of Lázaro Cárdenas. In addition, they are alleged to have confiscated shipments of iron ore and then exported it themselves. They are also alleged to have funded illegal mining operations where iron ore is mined without the requisite environmental permits.

In response, the Mexican government has tightened the regulations for iron ore exports, which now require exporters to demonstrate that all ore being shipped has been mined legally. The main market for Michoacán iron ore is China. It is no coincidence that ore exports to China have quadrupled in the past 5 years. The federal government also ordered the military to take over the administration of the port of Lázaro Cárdenas to put an end to corrupt practices and sever this major source of funding for the Knights Templar.

The discussion related to cartel financing via iron ore exports has implicated several transnational firms who are said to have paid the Knights Templar to allow iron ore shipments from their mines to the port. Michoacán supplies about 25% of all the iron ore mined in Mexico, and about 1 million ha (almost 20% of the state) have been given in concession to transnational mining firms such as Mittal Steel, Ternium (Italy-Argenina), Minera del Norte (a subsidiary of AHMSA) and Pacific Coast Minerals.

Claims, such as those reported here and here, that Minera del Norte paid the Knights Templar $2 dollars/ton to move 10,000 tons of iron ore a week from its four mines in the Tepacaltepec region, have been categorically denied recently by the company’s Communications and Public Relations Director, Francisco Orduña Mangiola. In an e-mail to Geo-Mexico, Orduña writes that his company “has never paid any amount of money to criminals”. He points out that, “On the contrary, it was precisely our Company that denounced the illegal operations of criminal groups in iron ore deposits owned by our company and other companies in the area, from which those groups extracted iron ore that was subsequently exported illegally to China. It was reported to federal, state and military authorities… and this action ultimately resulted in the confiscation of large amounts of illegal minerals in the ports of Lázaro Cardenas and Manzanillo. It is important to say that our company does not export iron ore, and that the lump iron ore extracted in mines located in the Pacific Coast is sent by railway directly to Monclova, Coahuila, and used as a raw material in our steel facilities.”

3. Port traffic and operations

A levy of up to 10% on goods passing through the port of Lázaro Cárdenas.

4. Miscellaneous money laundering activities

Purchase and sale of property, vehicles, cattle, textiles (imported from China and sold in Guanajuato after being relabelled with major brand names), truck tires, etc.

5. Extortion payments

Extortion payments received from truck drivers, gas stations, grocery stores, bars, restaurants, pharmacies, car lots, and even direct from municipalities (in exchange for “permitting” municipal works related to drainage, street lighting, paving). The rise of self defense groups was partially due to citizens’ outrage at the various extortion payments demanded by the Knights Templar.

6. Shipments and sales of drugs (as far away as California and Texas), many of them supplied via the port of Lázaro Cárdenas.

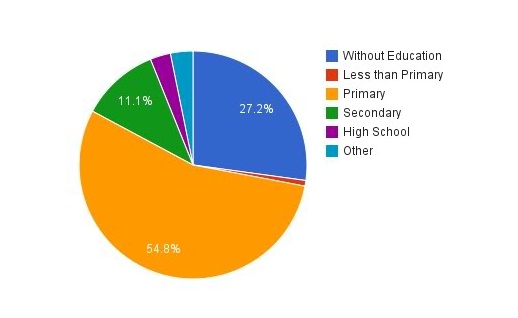

Summary of Knights Templar income from illegal activities [dollars a month]

- drugs, weapons, kidnapping, pirated items, vehicle thefts, etc: $2.8 million

- extortion rackets, $1 million

- extortion of municipalities, $1.1 million

- investments in real estate, vehicles, textiles, electronic items, etc., $1.3 million

The port of Lázaro Cárdenas was key to the Knights Templar financial plans, and effectively served as the cartel’s “gigantic central bank”, capable of supplying an endless stream of funds to the cartel. It remains to be seen how effectively the government decision to put the military in charge of administering the port will destroy the ability of the Knights Templar to raise funds to support their illegal activities.

Where does all this money go?

Part of it goes on bribing officials. According to an investigation published in Milenio, a national daily, the Knights Templar cartel is believed to spend $2 million a month in bribing officials in the state of Michoacán, and a further $400,000 a month in other states. The Milenio articles were based on an official intelligence report that their journalists were given access to for a few hours.

Sample payments made to officials range from up to $26,000 a month to a federal police commander in an important city to $19,000 a month to officials in the prosecutor’s office and $18,000 a month to a state police commander. Officials in smaller cities and local administrations are paid less.

Recipients of drug cartel money also include journalists, with some print journalists receiving $3,000 a month and payments of about $2000 a month to a TV executive.

Related posts (chronological order):