On 1 January 2014, the Mexican government implemented a 10% tax on refrescos (aka sodas, pop, carbonated drinks) and other sugar sweetened drinks, raising the price by 1 peso (about 7 cents US) per liter, in an attempt to help curb the nation’s obesity problem. The tax became law despite heavy lobbying against it by the beverage industry. An 8% tax was also added to unhealthy snacks like potato chips and cookies.

Now preliminary results of a study (not yet peer reviewed) by the Mexican National Institute of Public Health and the Carolina Population Center at the University of North Carolina, show purchases of sugary beverages dropped 6% on average across 2014, and by as much as 12% in the last part of the year. The study analyzed consumption in 53 Mexican cities, and adjusted for other factors like the small downward trend in consumption of carbonated drinks in recent years. The effect was greatest in lower income households where purchases were cut by 9% over the year and by 17% in the later months. Moreover, the researchers claim that Mexicans drank more water after the refresco tax came into effect.

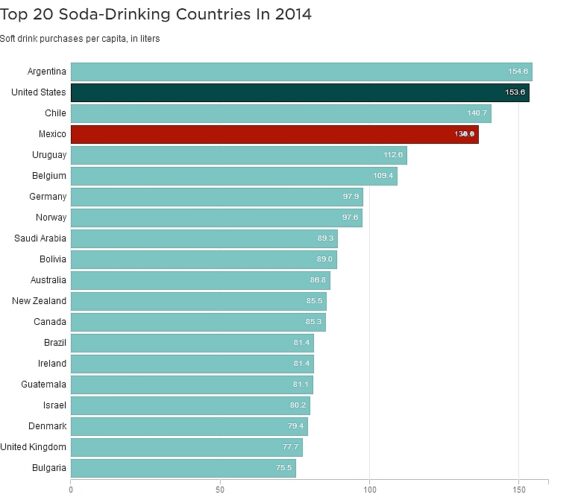

Mexicans’ consumption of carbonated drinks per capita is the fourth highest in the world (behind Argentina, USA and Chile), with the average Mexican drinking the equivalent of 136 liters of Coca-Cola a year. Government revenues from the new tax totaled 18 billion pesos (US$1.3 billion) in 2014. The National Health Alliance, a Mexican public interest coalition, is now calling for the tax to increase to 20%, and for the abolition of tax on bottled water sold in containers of under 10 liters, to make it cheaper than sugary drinks. The Alliance is also pressuring the government to follow through on its promise to use the tax revenues raised to fund programs to prevent obesity and its associated diseases – for example, making free, clean drinking water available in schools that don’t currently have it.

Mexicans’ consumption of carbonated drinks per capita is the fourth highest in the world (behind Argentina, USA and Chile), with the average Mexican drinking the equivalent of 136 liters of Coca-Cola a year. Government revenues from the new tax totaled 18 billion pesos (US$1.3 billion) in 2014. The National Health Alliance, a Mexican public interest coalition, is now calling for the tax to increase to 20%, and for the abolition of tax on bottled water sold in containers of under 10 liters, to make it cheaper than sugary drinks. The Alliance is also pressuring the government to follow through on its promise to use the tax revenues raised to fund programs to prevent obesity and its associated diseases – for example, making free, clean drinking water available in schools that don’t currently have it.

In its March 2015 report on Carbonates in Mexico, Euromonitor International, reporting from an industry perspective, concludes:

(The tax) is one of the many new strategies that the Mexican government is implementing to fight the rising obesity and diabetes II rates after becoming the leading country for obese or overweight citizens globally in 2013…The most affected carbonated products are those sold in big sizes where consumers are more aware of the increased cost. Some leading brands have their stronger position among the biggest sizes of the market, and these brands have seen a greater impact in their volume sales. Amongst carbonates, Coca-Cola (de México SA de CV) holds a 68% total volume share, followed by its closest competitor Pepsi-Cola (Mexicana SA de CV), at 16% .

Carbonates is expected to keep on struggling with volume growth in Mexico due to consumers wanting healthier options, the increasing trend of having RTD teas and increasing trend of fruit-flavoured beverages instead of carbonates. Additionally, government actions have strongly impacted carbonates’ consumption.”

Related posts:

Sorry, the comment form is closed at this time.