Much recent attention in the USA and Mexico has focused on the allegations of bribery related to Wal-Mart de México. Interestingly, the company has a rather long history in Mexico. It started in 1958 when Jerónimo Arango and his brothers Placido and Manual started a company called Cifra and opened a deep discount store in Mexico City named Aurrera Bolivar. It was inspired by the E.J. Korvette discount store in New York City. The store was an immediate success, helped by sponsorship of the popular TV show, La Pregunta de los $64,000 pesos (“The $64,000 Pesos Question”).

By 1965 Cifra had eight Aurrera stores in the Mexico City area as well as a Superama grocery store and VIPS restaurant. Cifra and Jewel-Osco of Chicago formed a joint venture and by 1970 they opened the first Bodega Aurrera discount warehouse stores and Suburbia department stores. Their first hypermarket, Gran Bazar, followed in 1976. Shares in the company were sold to the public in 1977. By serving low-income customers, the company managed to survive the financial crisis of 1982. In fact during the 1980s it increased sales by an average 20% per year reaching US$550 million by 1989.

Rapid growth continued in the 1990s. By 1992 there were 38 Almacenes Aurrera supermarkets, 29 Bodega Aurreras, 34 Superamas, 29 Suburbias (department stores), 59 VIPS, as well as 15 El Portón restaurants. Almost all of these were located in the densely populated Mexico City and surrounding State of Mexico. Phenomenal growth continued in 1992 with 23 new units added. Cifra B shares increased forty-fold in just five years from the start of 1988 through the end of 1992. At that time, Cifra had a sophisticated, state-of-the-art data system for inventory control and monitoring customer preferences.

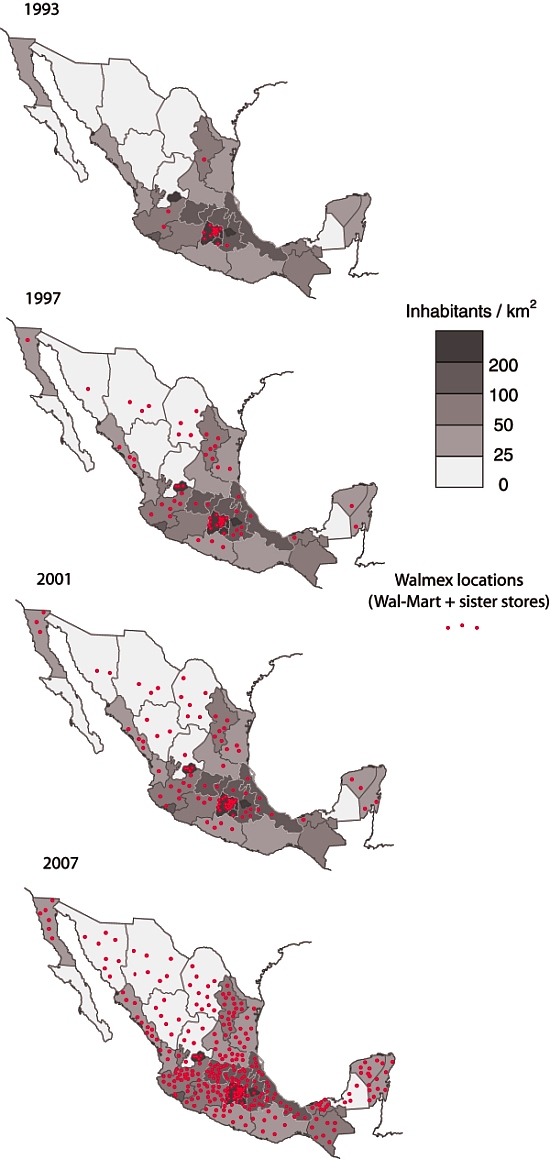

In 1991 Cifra formed a joint venture with the US firm Wal-Mart (founded in 1962, four years after Cifra). Unlike Cifra, whose early growth was based on an enormous urban area, Wal-Mart USA’s incredible early growth concentrated on rural areas. Initially the joint venture focused on trade and the members’ only Club Aurrera, which was soon renamed Sam’s Club. The first map shows the distribution of Wal-Mart stores in 1993. Expansion of new outlets throughout Mexico was only slightly slowed by the 1994 financial crisis.

By 1995, there were 22 Sam’s Clubs, and 11 Wal-Marts, 35 Almacenes Aurrera, 58 Bodegas Aurrera, 36 Superamas, 33 Suburbias, as well as 114 VIPS restaurants. One of the new Wal-Mart Supercenters was the largest in the world. The signing of NAFTA in 1994 strengthened the joint venture. In 1997 Wal-Mart USA acquired majority interest in Cifra creating Wal-Mart de Mexico or Walmex. The company, which previously had been heavily concentrated in Metro Mexico City, was soon aggressively opening new units in cities throughout the country (see maps).

Recent news reports allege that this aggressive growth may have been facilitated by payments of bribes to expedite construction permits. As of March 2012, Walmex was operating no fewer than 2,106 retail units throughout Mexico. They include 127 Sam’s Clubs, 213 Walmart Supercenters, 94 Suburbias, 385 Bodega Aurreras, 88 Superamas, 358 VIPS and El Portón restaurants, and over 840 Bodega Aurrera Expresses and other small outlets.

Wal-Mart de México is the country’s largest retailer, with sales of over US$24 billion, and largest private-sector employer, with 209,000 employees. These figures make Walmex the dominant player in its sector, well ahead of its Mexican supermarket rivals: Soriana ($8 billion); Comercial Mexicana (Mega, $4.5 billion) and Chedraui ($4.4 billion).

The 2007 map shows how Wal-Mart has now expanded into some areas where the population density is relatively low. The early expansion of Wal-Mart was into areas with high population density, where a single, well-placed store could easily be accessed by a lot of people, and therefore have the potential to be highly profitable. Even with the 2007 distribution, however, there is still a marked north-south divide in access to Wal-Mart, which reflects income disparities in Mexico.

In 2009/10 Walmex acquired Walmart Centroamérica and is now named Wal-Mart de México y Centroamérica, adding 622 retail outlets in Guatemala, El Salvador, Honduras, Nicaragua and Costa Rica, to bring the total number of units it operates (including Mexico) to 2, 728 retail outlets (with sales of about $29 billion) compared to Wal-Mart USA’s 4,468 outlets (with 2011 sales of $447 billion).

Source for maps:

The maps have been redrawn, based on maps in “Supplier Responses to Wal-Mart’s Invasion of Mexico” by Leonardo Iacovone, Beata Smarzynska Javorcik, Wolfgang Keller, James R. Tybout. Working Paper 17204 of the National Bureau of Economic Research, Cambridge, MA, USA.

Related posts

- Mexico’s North-South economic divide weakens slightly in 2009

- Where are the wealthiest households in Mexico?

- Consumer shopping habits and regions in Mexico

- The distribution of retail activities in the city of Zitácuaro, Michoácan, Mexico

Sorry, the comment form is closed at this time.