The Naica caves, in the northern state of Chihuahua are home to the world’s largest natural crystals. The crystals are selenite, said to enhance sex drive.

The formation of the crystals caves is described in more detail below, but in February 2017, Penelope Boston, head of Nasa’s Astrobiology Institute announced that “bizarre and ancient microbes” had been found in these caves. The discovery came after nine years of work and was first announced at the American Association for the Advancement of Science conference in Boston. The life forms in the Naica caves survive by living on minerals such as iron and manganese and could be 50,000 years old. The find is still subject to peer-review and independent confirmation:

How were the crystals discovered?

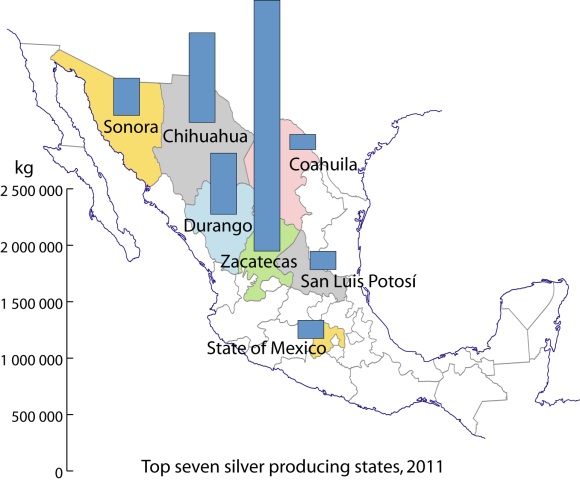

Early in 2001, news emerged of a truly extraordinary discovery in caverns deep under the earth in the state of Chihuahua. Miners tunneling through the Naica Hills, south of Chihuahua City, in search of silver and zinc, found huge mineral crystals, far larger than any natural crystals previously seen anywhere else on the planet.

The monster crystals, over six meters long, are made of selenite, a crystalline form of the mineral gypsum (the number one ingredient in blackboard chalk!). For its pale translucence, this form of gypsum is known as selenite, named after Selene, the Greek goddess of the moon.

The largest crystals are over 11 meters long, and weigh more than 55 tons. Scientists believe they have found DNA from ancient bacterial life trapped in air bubbles inside the crystals.

The crystals formed when the caverns were completely filled with hot water (warmer than 50 degrees C) supersaturated with calcium sulphate (gypsum) for very long periods of time. The estimated growth rate, confirmed by uranium-thorium dating, is 1.5 mm per 1000 years, which means that the longest crystals took more than 500,000 years to form.

The engineer working for the mining company Peñoles that first reported these caves believes that many more caves probably exist, but stresses that they would never have been located at all if it had not been for the mine’s massive pumps (pumping more than 16,000 gallons of water out each minute) working round the clock for years. This pumping has lowered the water table from 100 meters below the surface to about 300 meters in the area of the mines. Since the caverns have been drained, the crystals are no longer growing, and the temperatures in the cavern have fallen by about 0.5 degrees C each year.

The Naica (“shady place”) hills have been actively mined for more than a century. Even though early prospectors discovered silver here in 1794, the first formal mining claim was not made until a century later in 1896, by one Santiago Stoppelli, and large scale mining only began in 1900.

Ten years later, super-large sword-shaped crystals of selenite were found in a cavern at a depth of 120 meters. Over the years, a steady stream of geologists and mineral collectors have visited this 70-meter-diameter cave, since renamed the Cave of the Swords, which is now equipped with paths, lights and a ventilation system. Even with this system, the temperature in the cave is a stifling 40 degrees C! Several typical examples of selenite crystals from this cave, ranging in length from 1.2 to 1.6 meters (4 to 4.25 feet), are displayed in the Smithsonian’s National Museum of Natural History.

But these specimens from the Cave of the Swords are small fry in size when compared with the latest discoveries, 300 meters below the surface, in the Cave of the Crystals. In two relatively small chambers, each the size of a small apartment, miners found incredibly large selenite crystals, some over six meters long. The crystals combine to form massive fifteen-meter-long columns, “the size of pine trees”, as well as hundreds of formations shaped like sharks’ teeth, jutting about a meter up from the cave floor. The overall effect is, in the words of Richard Fisher, an Arizona-based photographer and adventurer, like walking into an enormous geode.

The Future

Mining operations at Naica have been in the hands of the Peñoles group since 1961 and the mine, one of the most productive in Chihuahua, still produces ample quantities of lead, silver and zinc.

Even if the silver ore is eventually worked out, Peñoles realizes that the caverns might have a very bright future as a major geo-tourist attraction. The company has not only taken steps to safeguard the crystals, but was already developing a tourism plan, which involved the installation of an air-conditioning system in the caverns, since the temperature in the Cave of Crystals is a mind-boggling 60 degrees Celsius. This heat, combined with the 100% humidity in the caverns, is so suffocating and disorienting that researchers can only safely spend a few minutes at a time studying this fantastic sight.

The harsh conditions have not deterred crystal looters who are already reported to be breaking through padlocked doors and trying to chisel prize specimens off the cave walls. This is a dangerous business and the effort proved fatal for one would-be collector when the gigantic crystal he was attempted to sever broke away from the ceiling and crushed him as it fell. The combined physical forces of Newton and Darwin caused this particular plunderer to meet his maker!

It was announced in October 2015 that Peñoles had been forced to close its Naica mine indefinitely, following its failure to reduce the level of water in the mine following a flood in January 2015. The company was seeking to redeploy more than 400 workers. In 2014, the Naica mine produced 19,694 tons of lead, 15,399 tons of zinc and 1.9 million ounces of silver (25% 6% and 3% respectively of the company’s total output of each metal).

Whether or not attempts will be made in the future to allow access to view the crystals is unknown. It is perfectly possible that other miners in the region might be lucky enough to find even bigger crystals nearby!

These cavers may never be suitable for sustainable tourism. To preserve these magnificent crystals for future generations, the decision may have to be taken to leave the caverns under water, protecting the crystals that already exist and allowing new ones to grow.

These amazing crystals are one of the latest additions to the incredible list of natural wonders that can be enjoyed in Mexico!

For truly amazing images of the crystals, watch the Discovery Channel documentary “Naica: Secrets of The Crystal Cave” (2008).

Note:

- This is an update of a post originally published in 2010

Mexico’s geology, relief and landforms are analyzed in chapters 2 and 3 of Geo-Mexico: the geography and dynamics of modern Mexico. Buy your copy of this invaluable reference guide today!

![Towns, by state (September 2015) [corrected]](http://geo-mexico.com/wp-content/uploads/2015/09/magic-towns-sep-2015-corrected.jpg)