Mexichem is a Mexican chemical and petrochemicals company (2014 total revenues: US$ 5.6 billion), with headquarters in Tlalnepantla, in Greater Mexico City. Mexichem is a world leader in making and marketing plastic pipes and other products required in the infrastructure, housing, telecommunications, drinking and potable water sectors.

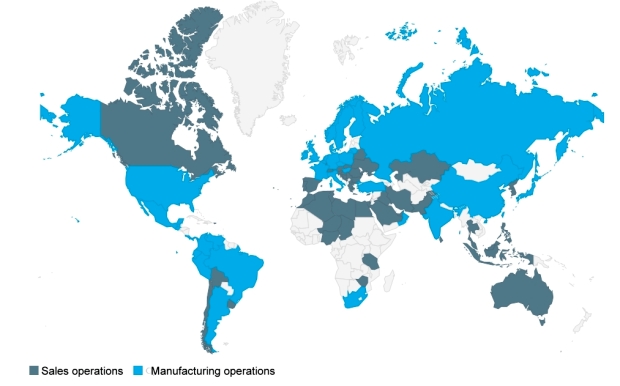

It employs 19,200 workers and has 120 manufacturing operations in more than 30 countries, with a sales presence in 90 countries.

The company’s origins date back to 1953 when a group of Mexican and English investors founded Cables Mexicanos S.A. to make high carbon steel wire ropes. Several changes of name and owners later, it emerged in 2005 as Mexichem. Mexichem has grown rapidly since then, largely due to an aggressive series of acquisitions.

In 2006, Mexichem bought Bayshore Group (PVC compounding). In 2007, it bought Amanco (PVC pipe systems and fittings), Petroquímica Colombiana (maker of PVC resins) and DVG, Industria e Comércio de Plásticos (producer of rigid PVC water and sewage pipes).

In 2008 Mexichem acquired Fluorita de Río Verde (fluorspar production plants and two fluorite mining concessions), Quimir (sodium phosphates), Geotextiles del Perú (geotextiles), Fiberweb Bidim Industria e Comércio de Não-Tecidos (Brazilian geotextile producer) and Colpozos (Colombia’s leading supplier of irrigation and well drilling systems).

The list goes on in succeeding years, with a succession of acquisitions of companies making PVC pipes, connections, polymers, resins, and fluorochemical competitors to become a world leader in the fluorine chemical segment, particularly in the production of refrigerant and medical gases.

To consolidate its fluorite business, in 2012, Mexichem bought Fluorita de México, ensuring access to the highest pure fluorspar available worldwide.

Mexichem has four main business divisions:

- Pipe systems, fittings, conduits and plastic accessories for the delivery of data, video, communications, electricity, water and gas. The pipe systems are made from polyethylene, PVC, polypropylene and specialty flame and smoke resistant compounds.

- PVC resin and valuable industrial compounds based on chlorine and caustic soda. PVC has uses from pipes that carry drinking water, wastewater or water for irrigation to construction materials and products, as well as auto parts, household appliances, clothing, footwear, packaging and medical devices. Caustic soda is used to make soap, shampoo, lotions and detergents and to treat water.

- Fluorine-based products, technologies and services. Mexichem’s “Mine to Market” structure ensures a secure supply chain of flourine-based products for the steel, cement, aluminum, automotive, refrigeration and pharmaceutical sectors.

- Energy. This division was created in 2014 in order to capitalize on opportunities arising from Mexico’s new energy policies.

A note on Mexico’s importance for fluorite

Exports of fluorite from Mexico were worth $180.7 million in 2014 (29% of the world total), making Mexico the world’s leading exporter of that mineral, ahead of China ($120.2 m). In 2014, Mexico mined 1.1 million metric tons of fluorite, and was the world’s second largest producer after China (4.4 million tons).

Mexichem sits on the world’s largest high-grade fluorite deposits, in its mine in San Luis Potosí. It produced 529,464 metric tons of fluorite from this mine in the first six months of 2015, 96% of the national total.

The world’s largest total reserves of fluorite are in South Africa (41 million tons), followed by Mexico (32 million), China (24 million) and Mongolia (22 million), according to U.S. government figures.

Related posts:

- Mexico’s food and beverage multinationals continue to expand

- Mexico’s multinationals: Groupo Bimbo, one of the world’s largest food companies

- Mexico is home to two of the world’s largest cinema multinationals

- Mexico’s multinationals: KidZania and its child-sized cities

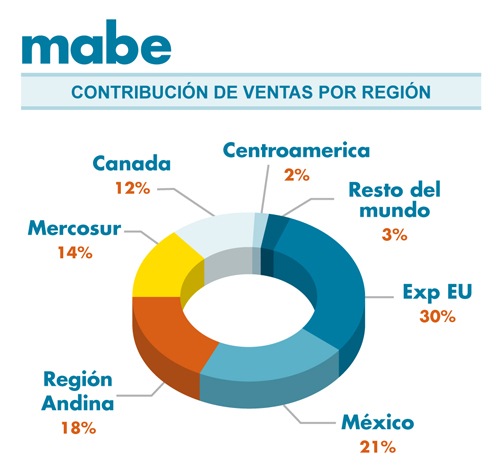

- Mexico’s multinationals: Mabe, domestic appliance manufacturer