The uneven distribution of farmland in Mexico was one of the fundamental causes of the Mexican Revolution in 1910, but by no means the only one. Landless campesinos (peasant farmers) lacked any way to control their own supplies of food. Revolutionary leaders called for the expropriation of the large estates or haciendas, which had been the principal means of agricultural production since colonial times, and the redistribution of land among the rural poor. A law governing this radical change in the land tenure system came into force in 1917 and the process has continued, albeit sporadically, into modern times.

About half of all cultivated land in Mexico was converted from large estates into ejidos, a form of collective farming. In most ejidos, each individual ejidatario has the rights to use between 4 and 20 hectares (10-50 acres) of land, depending on soil quality and whether or not it is irrigated. In addition, members of the ejido share collective rights over the use of local pasture and woodland.

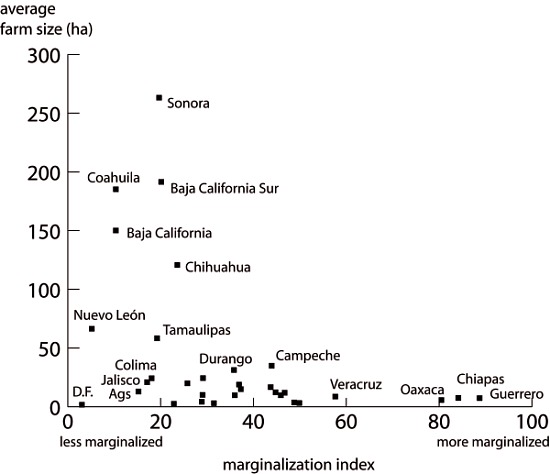

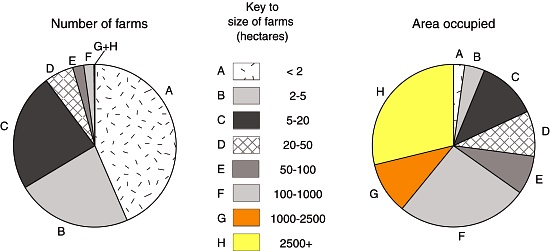

By 1970 land redistribution had been more or less completed. Even so, most farming land still remained in the hands of a very small minority of farmers (Figure 15.2). Only 1% of farms were larger than 5000 hectares (12,355 acres) but between them they shared 47% of all farm land. Meanwhile, 66% of farms were smaller than 10 hectares (25 acres) yet they shared only 2% of all farm land.

Have things improved since then?

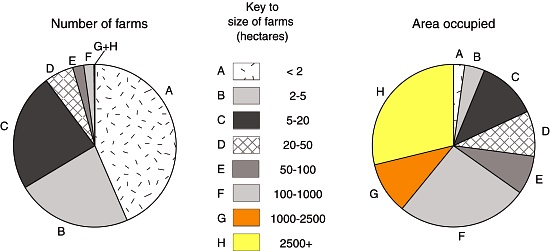

The 2007 farm census (see graphic) revealed that two-thirds (66.4%) of all farms are under 5 hectares (12.4 acres) in area; this percentage has remained roughly the same over the past 40 years. Between them, they farm just 6.2% of Mexico’s total farmland.

The number and size of farms, 2007 (updated Figure 15.2 of Geo-Mexico). Data: INEGI. Credit: Tony Burton / Geo-Mexico

The number of small farms has increased since 1970, but so has the total number of farms. Between 1991 and 2007, there was a 55.2% increase in the number of farms under 2 hectares in area, and a 45.4% increase in the total area they worked.

There is no solid data for why the number of microfarms has increased, but it may be partially explained by larger farms being split into smaller pieces (one for each family member) following the death of their original owner.

Most tiny farms are likely to be family-run, producing crops largely for subsistence, rather than for market. Small plots of land are likely to prove uneconomic and unsustainable to farm; it is impossible to generate sufficient profit from them for a family to enjoy a decent livelihood.

In one study, Enrique de la Madrid Cordero, writing for Financiera Rural, calculated that a typical smallholding of 5 hectares, planted with corn (maize) could generate a profit for the owner of about $4000 pesos. This profit represents 6 months work. At the time of his study, someone earning minimum wage for the same six months would have received a total of almost $10,000 pesos. The precise numbers vary, depending on average yields and the crops planted, but cultivating a smallholding is obviously not an easy way to make a living.

These same farmers are unable to advance since they have no means of accessing credit, having no suitable assets to offer as collateral, even if they could ever afford to pay the interest! Similarly, they do not have the savings to invest in improved equipment, higher cost seeds or to introduce new techniques or technology. They are, essentially, trapped in a cycle of poverty.

At the other end of the scale, a very small percentage of farms in Mexico are very large indeed. Nationwide, 2.2% of farms account for 65.1% of the total area farmed in the country. Larger farms are commercial operations, sometimes multinational operations. Their size and profitability ensures they have ready access to credit, and can adopt new technologies and methods relatively quickly.

The uneven distribution of land in Mexico clearly remains an issue, one that is likely to impact social justice agricultural output and productivity for decades to come.

Related posts:

Geo-Mexico has many other agriculture-related posts (easily found via our tag system). They include posts about the geography of growing/producing Christmas trees, cacao, honey, sugarcane, coffee, chiles, floriculture, tomatoes, tequila, horticultural crops and oranges. Also worth reading are:

The new power plant, owned by Corporación Aura Solar, is the largest photovoltaic power plant in Latin America, according to company chairman Daniel Servitje Montull. The 100-million-dollar plant occupies 100 hectares (250 acres) and was constructed by engineering firms Gauss Energía and Martifer Solar. The project relies on about 131,800 solar panels and has an estimated operational life of 30 years. About 25% of Mexico’s electricity is currently generated using clean energy sources. Mexico has set a national target of 35% clean energy by 2024, in order to minimize Mexico’s contribution to global climate change.

The new power plant, owned by Corporación Aura Solar, is the largest photovoltaic power plant in Latin America, according to company chairman Daniel Servitje Montull. The 100-million-dollar plant occupies 100 hectares (250 acres) and was constructed by engineering firms Gauss Energía and Martifer Solar. The project relies on about 131,800 solar panels and has an estimated operational life of 30 years. About 25% of Mexico’s electricity is currently generated using clean energy sources. Mexico has set a national target of 35% clean energy by 2024, in order to minimize Mexico’s contribution to global climate change.